Table of Contents

ToggleIPO Ki Duniya Mein Naya Tadka – Travel Food Services Limited

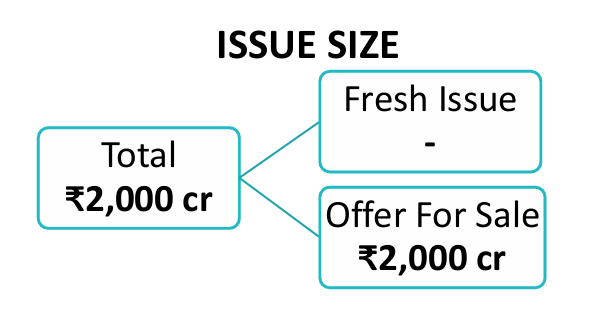

Travel food service company is coming with its ₹2,000 crore IPO in stock market, which can have many new opportunities for investors.

In this post, we will discuss in detail what is the business model of TFS, how has been its financial performance, what are the key highlights of the IPO, and whether you should invest in it or not. So if you are also an investor who not only enjoys “airport ka khana” but can also see the potential in it – then this post is for you.

What is Travel Food Services?

Travel Food Services Limited was incorporated in 2007 and is an Indian airport travel quick service restaurant (QSR) and lounge company. TFS opened its first QSR at Terminal 1B of Mumbai Airport. The travel QSR business comprises a range of curated food and beverage (F&B) concepts across cuisines, brands & formats,

which have been adapted to cater to customers’ demands for speed and convenience within travel environment.

Business Model of TFS:-

The Travel Food Service model is simple, but the executive is large and organized.

Networks & Brands:

QSR Outlets: As of 31st March 2025, they have 442 travel QSRs (384 in india 29 in Malaysia and 29 in highway sites of india)

Lounges: As of 31st March 2025 37 lounges (28 lounges in India, 8 lounges in Malayasia and 1 lounge in Hong Kong).

Brands: As of 31st March 2025, the company has 127 F&B brands ( 32 international brands, 58 as Indian brands and 37 in-house brands.)

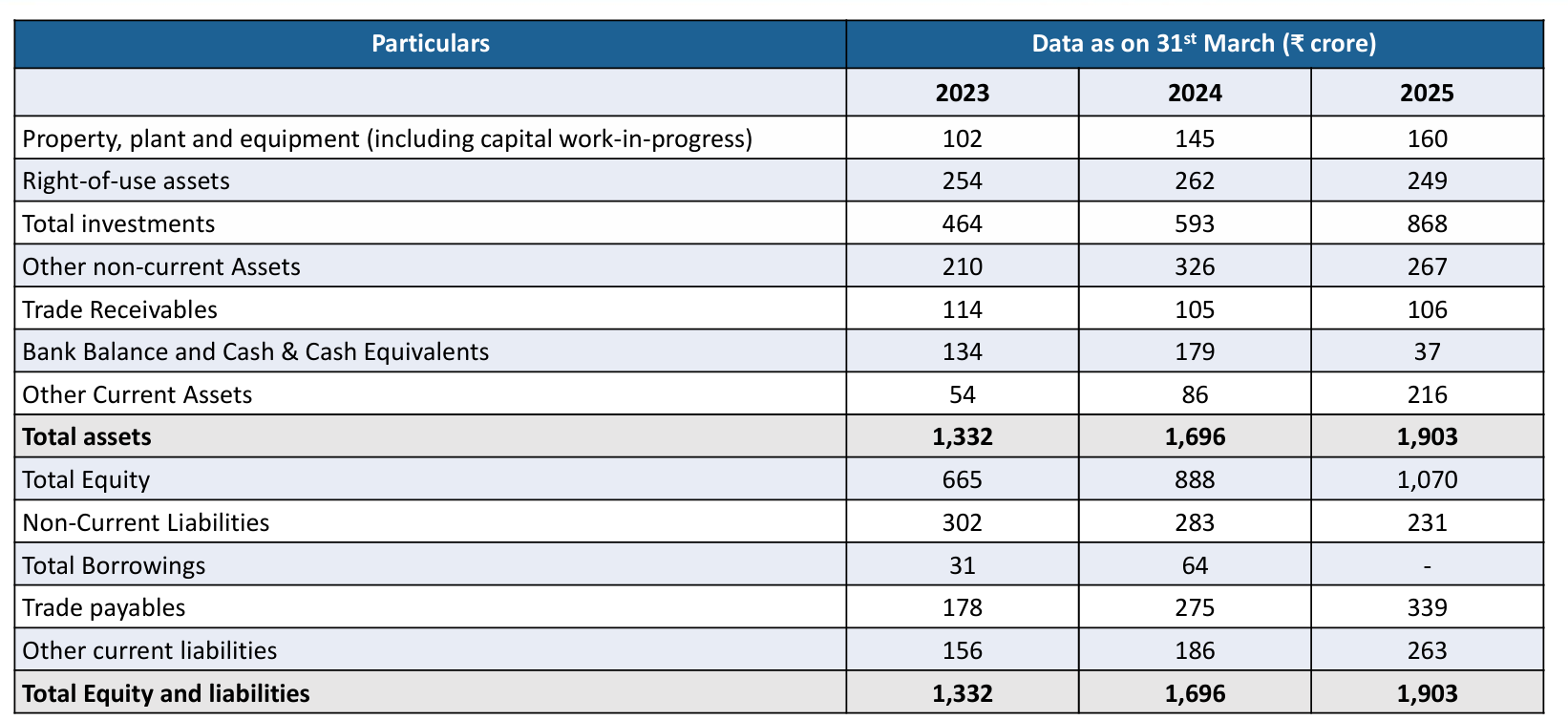

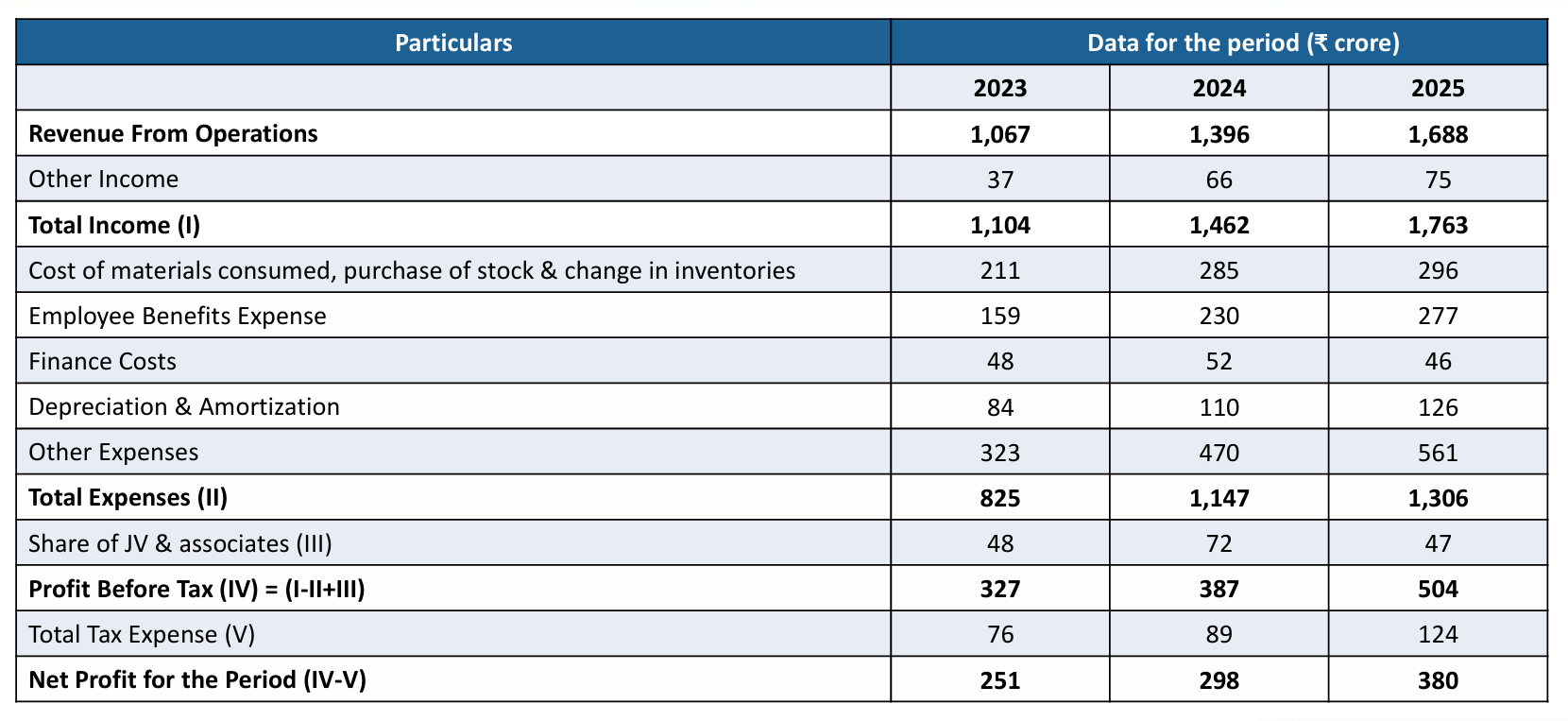

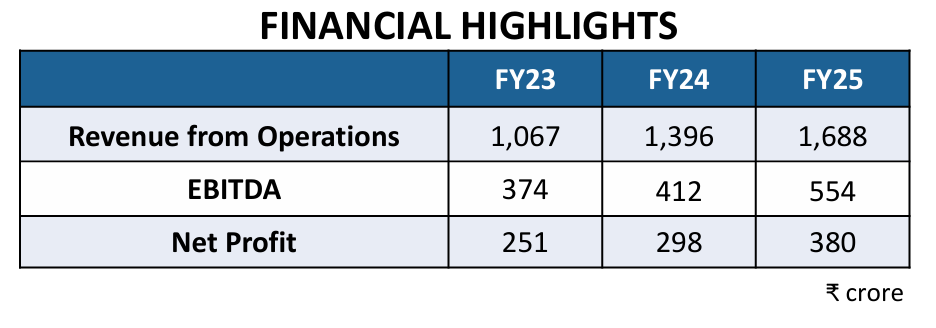

Travel Food Services Financial Highlights:

Whenever a company comes up for IPO, the first question is – “Is it making money or just making noise?” So let’s see how the money making track record of Travel Food Services (TFS) has been.

Travel Food Services has shown strong and sustainable growth in the last 2-3 years. It is a profitable, stable and capital-efficient company – which can be a “delicious” opportunity for investors as well as travel.

Profit and loss Account

Balancesheet

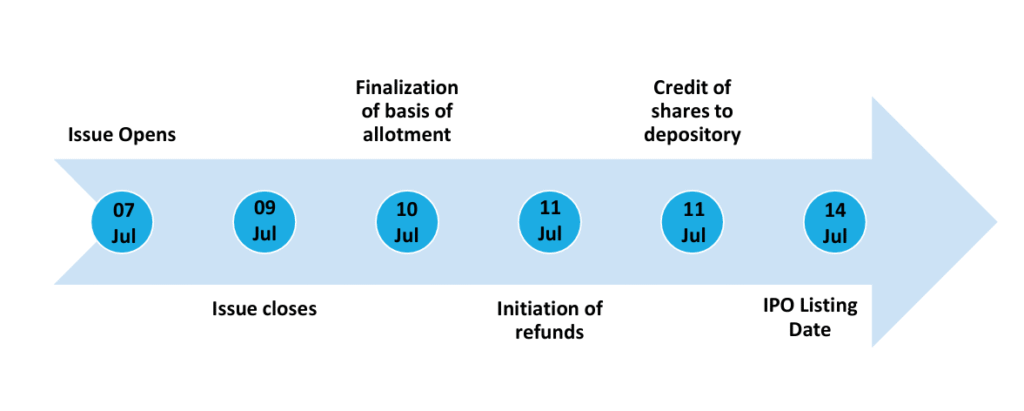

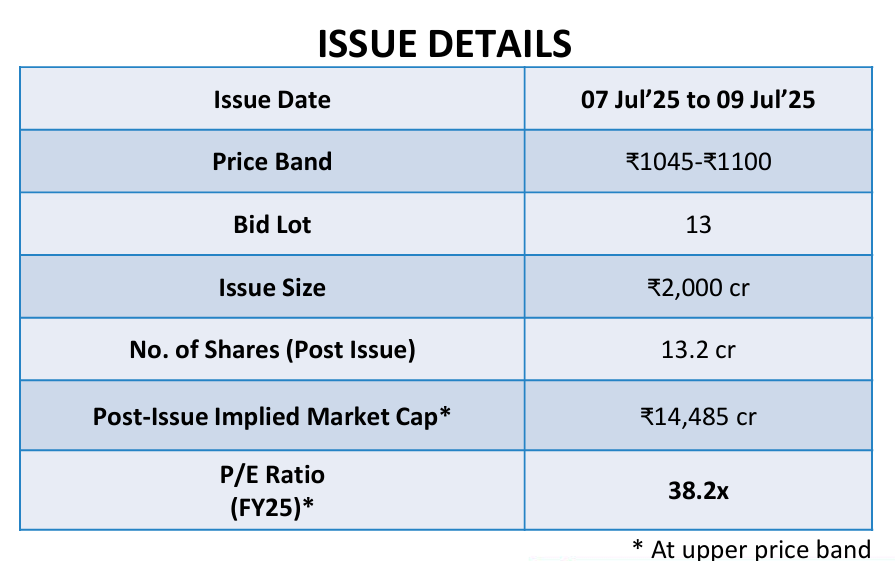

IPO Issue Details:

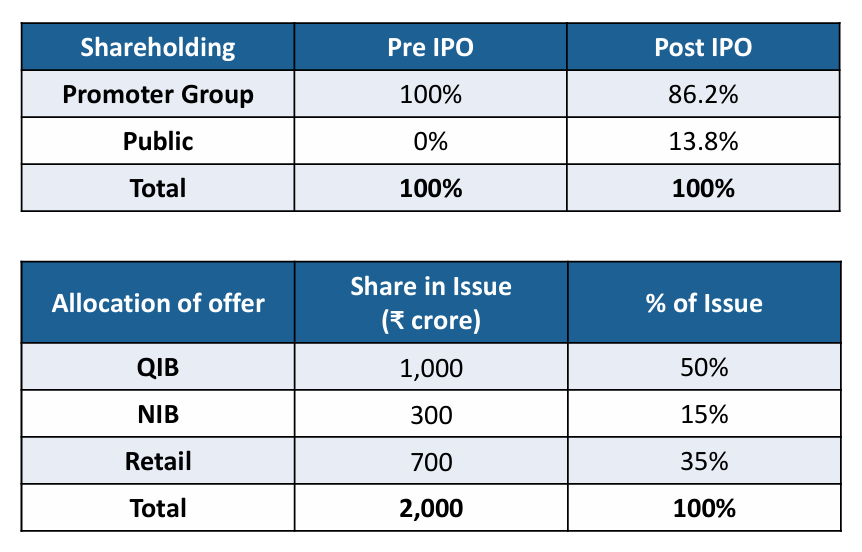

PROMOTER BACKGROUND AND SHAREHOLDING

SSP Asia Pacific Holdings Ltd is one of the promoter of the company with major shareholding. It is the holding company of SSP Group PLC, engaged in Asia Pacific business.

Kapur Family Trust is one of the promoters of the company. The trust was created to ensure smooth generational transfer. Varun Kapur & Karan Kapur are the major

beneficiaries. Kapur family is releasing liquidity- selling its shares worth ₹2,000 crore through IPO.

SSP Group is strengthening solid stake.

Ownership and control of companies is still with trustworthy corporates- i.e. TFS will remain stable.

Promoters:

- Kapur Family Trust ( Pre-IPO: 51% stake)

- SSP Asia Pacific Holdings Ltd (Pre-IPO: 49% stake)

Strengths & Growth Prospects

Travel Food Services has a dominant position in India’s airport food business.

- Travel Food Services Ltd is an Indian airport travel QSR and lounge player with a range of curated F&B concepts across cuisines, brands & formats.

- The company has 24% market share in the QSR (Quick Service Restaurant) segment and ~45% share in the airport lounges segment.

- The company is well-positioned to benefit from sectoral tailwinds such as rising propensity to spend, increasing air passenger traffic & longer dwell times.

- Several government initiatives are leading to subsidized F&B prices, exposing the company to customer retention risks. Additionally, high regulation & contract terms pose further risk.

Risks & Considerations

- Renew existing concession agreements: The company operates business through concession agreements, lease, license & tenancy agreements with the airport operators for its travel QSR & with airlines, card issuers & loyalty program networks for its lounge bus. As of 31st March 2025, ~20% of the company’s agreements would expire in the next 3 years. Additionally, reduction in passenger traffic at its top airports could have a significant impact on revenue.

- Attract new brand partners: InFY25, ~54% of travel QSR revenue came from partner brands. They depend highly on relationship with their partner brands and

failure to attract new brand partners or maintain or develop existing ones could adversely affect the business. - Extensive regulations: Theyaresubject to extensive regulations, particularly relating to airport and highway operations, security, food health & safety and environmental matters. Any non-compliance with or changes in regulations applicable to them may adversely affect results of operations.

- Udaan Yatri Café: The government’s initiative named ‘Udaan Yatri Café’, offers airport travelers with basic menu items at more affordable prices, which may draw away some customers from its Travel QSR outlets and reduce sales at such outlets.

Disclaimer:

This document is published for learning purposes only and nothing contained herein shall be construed as a recommendation on any stock or sector.